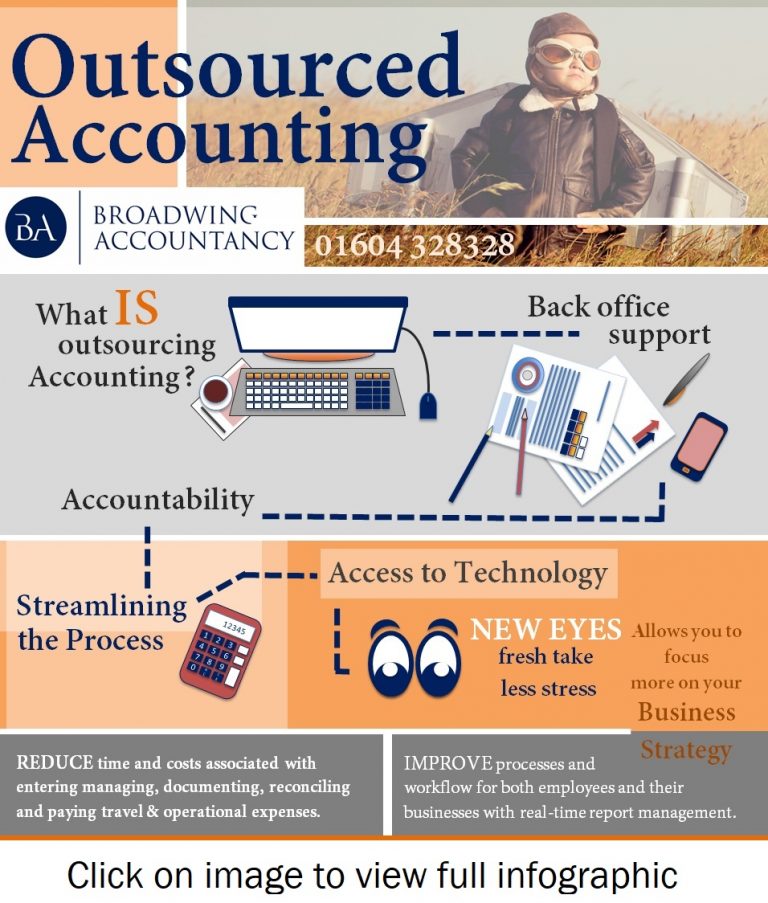

Outsourced accounting is essentially back office support, which includes professional help with accountability, streamlining the process, and access to technology. With new eyes and a fresh take, there is less stress, therefore, allowing you to focus more on your business strategy.

With outsourced accounting, you can reduce time and costs associated with entering, managing, documenting, reconciling, and paying travel and operational expenses. Along with that, you can improve the processes and workflow for both employees and your business with real-time report management.

You will improve the experience for vendors and business partners while leveraging mobile technology to enhance digital documentation and workflow. Along with that, you can integrate expense management into the company’s accounting system.

Working in partnership with you, Broadwing Accountancy can produce the management information that best suits your business and management team. Services include: –

- Bookkeeping services

- Monthly payroll including annual HMRC requirements

- Work place pension scheme setup

- VAT registrations and quarterly VAT returns preparations

- Management accounts and reports

- Financial modelling

- Cloud base accounting

- Preparation of statutory accounts for audit or non-audit clients

Outsourced accounting saves money by eliminating costly benefit packages, e.g. full or part time employee. There are also savings in productivity costs too.

The cost benefits analysis of outsourcing accounts vs. in-house bookkeeping can save up to 40% in monthly costs.

Fraud Prevention

Outsourced accounting increases internal controls.

Most SMEs are victims of fraud which cost £9bn per year in invoice fraud, equating to an average of £1,168 per year per SME. In 2016, 1 in 6 SMEs fraud cost them more than £5k.

Almost ½ of SMEs are concerned about the rate in which fraud is accelerating, and a staggering 47% have received a fraudulent/suspicious invoice in 2016. But only 44% would call the police, 8% would take no action and 13% don’t know what they’d do.

Outsourced accounting offers options, valuable feedback, and suggestions to grow your business, which provides a means to financial flexibility. By having a team of professional accountants working on your books allows for more reliability than having an in-house employee keeping them. Outsourcing accounting operations affords you a team of people to collaborate on your accounting needs and reporting and to double-check each other to ensure accurate findings.

With just one in-house accountant, it’s too difficult to hold departmental purchasing and spending individually accountable. Outsourcing enables an organisation to receive a quality service while meeting deadlines.

Faster Turnaround Time

A client gets service within the deadline as its outsourcing partner has all necessary resources for streamlining client-specified accounting processes with a faster turnaround time. Outsource your accounting to a full-service accounting firm, which allows for communication amongst the various departments and ensures deadlines are met on a timely basis with limited work required from business owners.

Outsourcing provides business owners the time to focus on core competencies.