Continuing with our series of “It’s not what you make – it’s what you get to keep”, this month we’re taking a closer look at travel expenses: what you can and can’t claim for.

It’s been the dream of many people (certainly pre-COVID) to explore the world and get paid for once-in-a-lifetime experiences. Just a quick look at Instagram will have you falling down a rabbit hole of incredible vistas, foodporn galore, and a culture of hedonistic travel. It looks blissful, but the travel influencer industry is highly competitive.

If you’ve managed to carve out a place for yourself in this industry, serious kudos to you! Now, let’s take a look at what you can claim against tax as a legitimate travel influencer.

Remember the definition of allowable business expenses

Allowable business expenses are purchased products or services that help to keep a business running. These are deducted from income when calculating taxable profit (meaning that they will not be counted towards your tax bill).

Planes, trains and automobiles

Obviously, as a travel influencer, your business will involve costs such as flights, trains and car rental. Let’s say for example that a hotel in Dubai has offered you a “complementary” week-long break at their establishment, in exchange for your doing several posts about the hotel.

You have a written agreement with the hotel that you will do five posts for each day of your stay. The hotel wants these posts to be centred around the facilities (the pool, the spa, the gym, the beauty salons) and the bars and restaurants within the hotel.

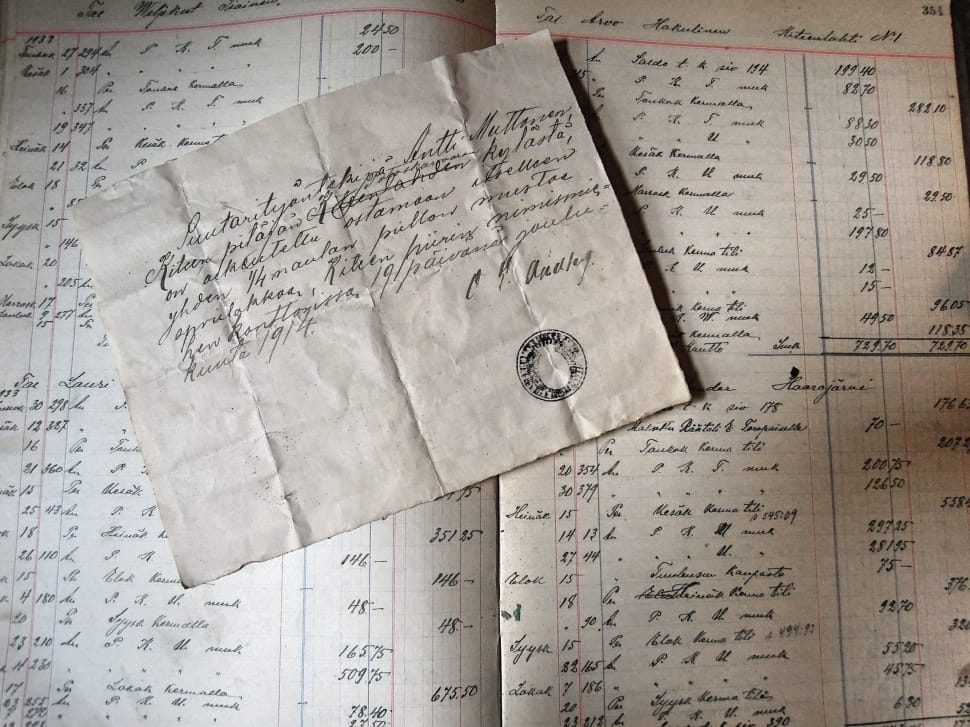

It’s always best to get these agreements in some form of written communication (even an email is fine) so you have a paper trail of work expected and work done. Remember, scrupulous record-keeping will be your best friend in this relatively new and unregulated industry.

So, you’ve got the accommodation provided for, but you need to get to the hotel under your own steam. Of course, you’ll be flying over to Dubai, so you can claim back the cost of that flight against tax. Don’t forget those other seemingly incidental expenses, such as a train fare to the airport, or parking charges for the week that you’re away. These can all be claimed for.

If the hotel were also paying for your flight as well as your stay, you wouldn’t be able to claim for this. If you decided to “bump” your paid-for ticket up to first class and cover the difference yourself, this isn’t something you’d be able to claim for, as it’s a personal expense outside of your working agreement with the hotel.

Flight and accommodation are sorted – what’s next?

Let’s take a look back at the work you’ve agreed to do with the hotel: five posts for each day of your stay, centred around the hotel leisure facilities (the pool, the spa, the gym, the beauty salons) and the bars and restaurants.

What might these posts entail that could be a legitimate expense?

Clothing

If you’re going to be spending some time in high-end restaurants and bars, there may be dress codes that you need to adhere to. Perhaps you need some matching activewear for those gym shots or a new swimsuit from a brand that the hotel has an agreed partnership with.

This doesn’t mean that you can rush out and buy a whole new wardrobe (sadly!). Keep in mind that any spending must be specific to the job that you’ve been hired to do.

Double check with the hotel: do they have dress codes? Is there a rule that high heels lower than 4 inches are not allowed in certain bars or clubs? Is there an activewear company that the hotel wants you to promote? Are there particular colours that the hotel wants you to wear, to complement the decor?

Get these questions answered before you spend any money. This way, you’ll know exactly what’s needed to do the job, and again you’ll have that paper trail for your records to prove that items claimed for were bought specifically to do this job.

Food and drink

As you’re away from home and technically working, you can claim reasonable costs of eating and drinking. The key word here is reasonable. A glass of wine with dinner might be considered a reasonable expense. A £1000 bottle of champagne and half a cow for one is unlikely to be accepted as reasonable.

Generally speaking, if a hotel wants you to promote a high-end drink or meal, they will provide you with that drink and write it off as a marketing expense in their own business.

If in doubt, remain sensible: can you afford that £1000 bottle of champagne if you’re not able to claim for it on your tax return? If the answer is “no”, then don’t buy it.

Beauty treatments

This hotel wants you to promote its spa facilities. Again, it’s a good idea to ask for specifics: are there any treatments in particular that the hotel wants you to feature, such as a gel manicure, or shiatsu massage? Or do they simply want selfies of you on a sun lounger?

As with clothing, get these specific expenses set out before you spend any money.

If the hotel just wants those selfies of you poolside, then claiming for a lip filler treatment as a business expense is not going to hold water, as it’s a personal expense that is outside the remit of the work the hotel has hired you to do.

Everyone is looking to be tax-efficient at the end of the day. We educate clients on managing their money (no unnecessary spending – it all adds up). Social media is, by its very nature, fickle – our behaviours and habits will change, and it can happen rapidly. Scrupulous record-keeping and sensible claims will stand you in good stead.

In our next blog, we’ll take a look into when it’s time to incorporate your business. In the meantime, you can call us with any questions about tax and financial planning on 01608 328 328, or email us at [email protected]