Is your goal to grow a thriving business?

Do you have a safe pair of hands handling the accounts?

No? Did you know inaccurate bookkeeping can harm your business and can even result in severe penalties?

Having strong financial statements can save you and your business in many ways too.

Being an entrepreneur, you’re always looking ahead, and always looking for the next opportunity, for the next challenge and for tomorrow’s customers. This is a great characteristic to have, but few entrepreneurs are reluctant to break their stride to have to deal with a pile of paperwork.

Have you thought of it in football terms? Entrepreneurs are the attacking players; the strikers and wingers who care constantly striving to score goals. But it’s no good being able to score goals if you also keep conceding them, which is why you need a strong defence and a great goalie. And in the business world, your goalkeeper is your bookkeeper.

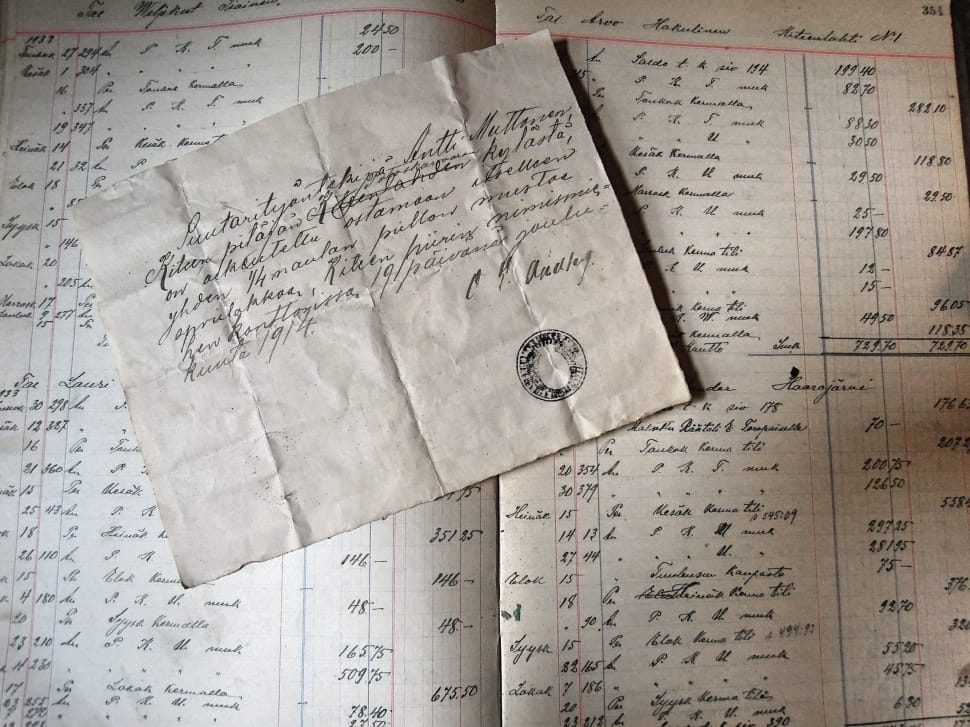

The bookkeeper’s job is to keep rigorous accounts of all financial transactions – everything the business sells, buys, owes and is owed. This is vital, and not just because you need accurate annual financial statements. Good bookkeeping can also help with the more exciting, forward-planning side of things – because knowing the past makes it easier to predict the future.

Here are some of the key things a good bookkeeper should do: –

1). Keep your business and personal finances apart

If you’re a sole trader, you do not legally have to have a separate business account, but it is sensible to have one nevertheless, otherwise your books will become a nightmare unless you record every penny you spend personally.

If your business is a limited company, it is a separate legal entity from you, so its money is not yours to spend (except on business expenses).

Tip: With a limited company, never forget which assets are yours and which belong to the company.

2). Keep clear and separate records

Bookkeeping typically requires at least three ‘books’ (i.e. financial records): the cash book, sales invoices, and purchase invoices.

- The cash book records everything passing in and out of the business’s bank account. This record of cash flow makes it an invaluable planning tool, as you can use it to underpin forecasts.

- The sales invoice file keeps a record of all your sales. Keep unpaid invoices together in a separate section.

- The purchase invoice file records all purchases chronologically, along with the payment method.

Tip: Take care when recording non-sales deposits. For example, if you transfer personal savings into your business, make sure it is not accidentally recorded as income – because then it may be taxed.

3). Control your credit

A full sales ledger is a beautiful thing, but if your customers haven’t paid yet, that beauty is only skin-deep. It is important to set strict deadlines for your customers to pay their bills to you, and consider blacklisting repeat offenders. You must chase every late payment, as each is essentially an interest-free loan, and without a rigorous credit control, a small business can quickly develop a cash-flow crisis.

Tip: Practice what you preach – make it a point of courtesy to pay your own bills on time! Paying bills more promptly than required is another needless drain on your cash flow.

4). Track expenses

Business expenses can be claimed against tax, so tracking them is essential for cutting overheard and maintaining healthy cash flow. Use a business credit card where possible (as this itself provides a basic accounting system) and keep careful records of all other expenses, categorising them by business activity.

Categorisation of expenses can prove especially important if your business happens to be audited. Numbers on tax returns are frequently estimates (e.g. £3,000 on printer toner) so it really helps to be able to provide supporting evidence for these.

Tip: Remember that even trivial expenses add up. Keep records of things like business mileage, trips and corporate entertainment so that every claim can be substantiated if necessary. Otherwise there is a risk that HMRC may reject your claim for business expenses.

5). Plan ahead

Keeping track of where you have been, helps you plan for the future. By looking at the past year’s books, you can usually spot the times when a bit more forward planning would have saved you money and stress.

What should you do?

- Identify the major expenses of the year ahead and fix them in your business plan.

- Anticipate likely business costs (e.g. insurance premiums or IT upgrades) but always give priority to your tax obligations – you won’t be able to delay these.

There may be times when your business seems awash with cash, and you may be tempted to take out more than usual – having a full roadmap of future expenses will warn you to be careful.

Tip: At the very least, have your bookkeeper work out your probably tax bills in advance, and set aside the money for them. This is one debt deadline that you really don’t want to miss.

Bookkeeping may not sound like the most glamorous role in the business, but ultimately every other role depends upon it. So, having a safe pair of hands behind you to take care of the books provides you, as business owner, the freedom and confidence to lead from the front.

If a bookkeeper is not for you, why not get an accountant to take care of your books? Not only can they look after your books, but can also offer and provide a wide range of other valuable services for your business.

If you would like to find out how Broadwing Accountancy could help you, or discuss any other accounting topic, please contact Brian Munjanja TODAY on 01604 328328 or by email [email protected].